The Dawn of the E-wallet Infinity War

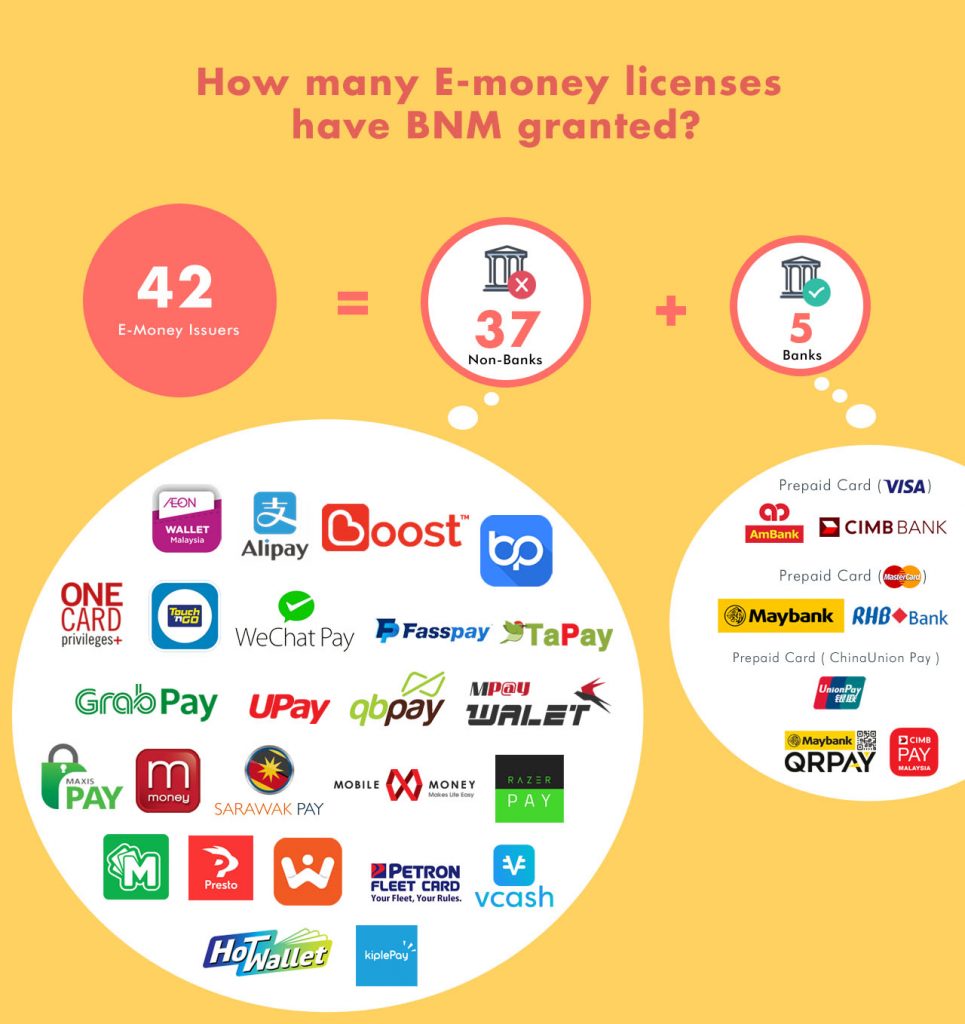

The emerging of technology has changed the working process in various industries including payment methods are moving forward to “cashless”. Although there are still 80% of cash usage in the society, there are other payment options as well including credit card, debit card, online banking and e-wallet. In addition, the payment process of E-wallet is significantly different from cash and card payments, it has changed the way that consumers pay for both online and offline products. E-wallet stores individual’s digital money on the cloud which is safe and convenient. There are 37 non-bank e-money companies license are officially being issued by Bank Negara Malaysia. E-wallet providers are having a long-term battle with each other to continuously lure consumers to adopt and become a habit of using the e-wallet.

The mobile user has been increasing from day to day and time spent on using the mobile application are longer than before which makes a fast growth in mobile payment. Cash usage will reduce overtime when a number of people using e-wallet as their main mode of transactions. Moreover, online payment providers like iPay88 have offer e-wallet as one of the payment options. Consumers are able to use e-wallet for payment for online and offline.

Another benefit of e-wallet is consumers able to make payments to each other which is known as P2P transfer. The sending and receiving of money using e-wallet application are faster and easier than online transfer. Furthermore, merchants can combine or collect big data, analytical to serve the users better. E-wallet application also offers rewards or discounts to users in retaining user’s loyalty and keep the customers coming back.

Who are the e-wallet providers in Malaysia?

Bank Negara Malaysia has issued a total of 42 e-money licenses at the time of publishing including 5 banks and 37 non-banks.

| E-money Issuers (Banks) Total 5 | E-money Issuers (Non-Banks) Total 37 | ||

| AmBank (M) Berhad | Prepaid Card

(Master Card) |

AEON Credit Services (M) Berhad | AEON e-wallet |

| Bank of China (M) Berhad | Prepaid Card

(China Union Pay) |

Alipay Malaysia Sdn Bhd | Alipay |

| CIMB Bank Berhad | Prepaid Card (Master Card)

CIMB Pay |

Axiata Digital eCode Sdn.Bhd. | Boost e-wallet |

| Malayan Banking Berhad | Prepaid Card (Visa)

Maybank Pay & Maybank QR Pay |

Bandar Utama City Centre Sdn.Bhd. | ONECARD |

| RHB Bank Berhad | Prepaid Card (Visa) | BigPay alaysia Sdn.Bhd. | BigPay e-wallet |

| Celcom eCommerce Sdn.Bhd. | N/A | ||

| DIV Services Sdn.Bhd. | Card for School | ||

| Fass Payment Solutions Sdn.Bhd. | Fasspay e-wallet | ||

| Fiexus Cards Sdn.Bhd. | Kedah Pay | ||

| Fullrich Malaysia Sdn.Bhd. | TaPay e-wallet | ||

| GPay Network (M) Sdn Bhd | GrabPay e-wallet | ||

| IPay88 (M) Sdn Bhd | White label e-wallet solutions to partners who provide wallet solutions for their community | ||

| I-serve Payment Gateway Sdn Bhd | Upay | ||

| JuruQuest Consulting Sdn Bhd

|

QBpay e-wallet | ||

| ManagePay Services Sdn. Bhd. | Maxis Pay | ||

| Merchantrade Asia Sdn Bhd | Merchantrade Money e-wallet | ||

| Mobile Money International Sdn. Bhd. | Mobile Money | ||

| MobilityOne Sdn Bhd | One Pay | ||

| MOL AccessPortal Sdn. Bhd. | Razer Pay e-wallet | ||

| MRuncit Commerce Sdn.Bhd. | MCash e-wallet | ||

| Numoni DFS Sdn.Bhd. | NAPP- Money Transfer App | ||

| PayPal Pte.Ltd. | PayPal | ||

| Petron Feul Interternational Sdn.Bhd. | Petron Fleet Card | ||

| Presto Pay Sdn Bhd | Presto e-wallet | ||

| Raffcomm Sdn.Bhd. | HotWallet e-wallet | ||

| Shell Malaysia Trading Sdn.Bhd. | Shell Fleet Card | ||

| SiliconNet Technologies Sdn.Bhd. | Sarawak Pay e-wallet | ||

| Silverlake Global Payments Sdn.Bhd. | UTAR Silver Card | ||

| SMJ Teratar Sdn Bhd | eWang e-wallet | ||

| Touch ‘n Go Sdn.Bhd. | Touch ‘n Go Card | ||

| TNG Digital Sdn Bhd | Touch ‘n Go eWallet | ||

| Valyou Sdn.Bhd. | Vcash e-wallet | ||

| WeChat Pay Malaysia Sdn.Bhd. | WeChat Pay e-wallet | ||

| Webonline Dot Com Sdn.Bhd. | KiplePay e-wallet | ||

| XOX Com Sdn.Bhd. | MyXOX | ||

Which e-wallet providers will stay in the long run?

It can be considered as a race among all the providers especially the providers have access to an existing user base in the millions namely Touch ‘n Go Digital (a joint venture between Alipay and Touch ‘n Go), WeChat Pay (Tencent Group), GrabPay, Boost (Axiata), BigPay (75% owned by AirAsia), and AEON Wallet (AEON Group).

Boost by Axiata Group is a network-based e-wallet provider that started from scratch and now acquired over 800,000 users with online and offline merchants located in over 5000 locations across Klang Valley. Its aggressive marketing is the “shake rewards” for each transaction made that mainly the reason of gaining users.

In fact, Malaysian started their cashless journey over 20 years ago with the Touch ‘n Go card but recently Touch ‘n Go Digital is transitioning users in a faster way along the cashless journey. Touch’n Go Wallet accessible in public transportation such as toll, bus payment and parking. It incorporates two unique features which are RFID and PayDirect providing flexibility, enable Malaysians to have a more seamless journey and ease traffic flow.

Grab Pay services are best known associated with e-hailing services with 120 million downloads across Southeast Asia. Users are able to pay for Grab rides by topping up their e-wallet and complete transactions at physical stores or restaurants. Grab users able to gain or earn points that can be exchanged for Grab Rewards.

Understanding e-wallet

E-wallet is a digital equivalent of a real-world physical wallet which mainly targeted to mobile users. Users store money, credit card, debit card or prepaid details inside the digital wallet and the user’s personal information is encrypted and stored securely. Besides, it has other features build-in such as parking payment, voucher purchase or bill payment to enhance the application itself to make it convenient and useful for the consumers. E-money is the notes and coins that appear as digital numbers inside e-wallet. Transaction only can be done while the user can make payment and merchants accept e-money as payment.

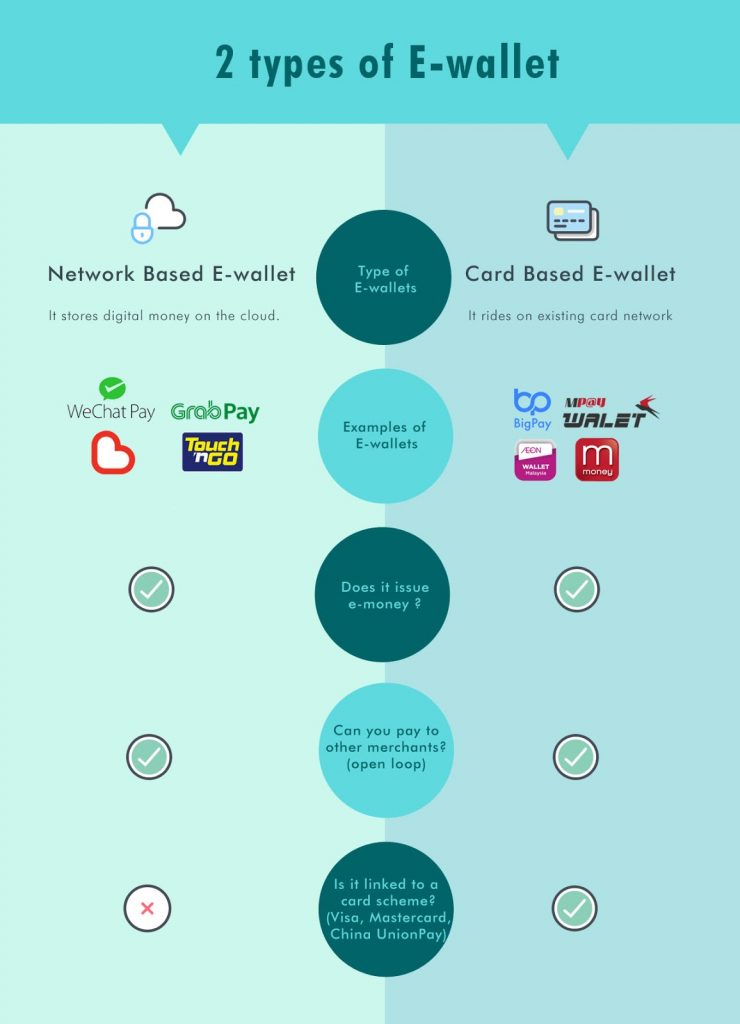

Hence, customers no longer bringing along lots of cash with them nowadays and the payment method has slowly replaced by either network-based e-wallet including WeChat Pay, Grab Pay, Boost and Touch’n Go e-wallet or card-based e-wallet that riding on existing card network. For example, AEON Wallet ties to Visa Prepaid Card.

It is simple to differentiate the e-wallet and mobile payment app. A fully functional e-wallet has to fulfill a list of criteria such as:

- It has to be available as an app for both Android and iOS (Apple).

- It must allow you to top-up the balance, via online banking, debit card, credit card, or cash.

- It must allow you to do a Personal to Personal (P2P) transfer.

- It must allow you to scan a static QR code by the merchant to make payment.

- It must be made available to all the consumers (mass market).

- It must already be accepted by merchants (physical brick & mortar or online).

- It must be an open-loop – support payments to third-party merchants.

- It must obtain the e-Money Issuers License from BNM.

Why should retailers care?

Digital payments are evolving fast whereby e-wallet has adopted by retailers. This is because e-wallet offers a lower transaction cost compared to a credit card. It is 1.2% or below and zero transaction fee which has encouraged merchants adopting e-wallet. By adopting e-wallet, the transaction able to speed up with less human error especially short of money. Moreover, marketers or retails do care about the customers, they start to know the name of a customer via their e-wallet account and other features as well. E-wallet benefit retailers in tracking customer purchasing behavior and acquire new customers.

How to differentiate Static vs Dynamic QR payment?

There are 2 types of QR payment mode:

Static QR Code: The information encoded in static QR codes is fixed and the data stored in the QR code cannot be changed. Customer needs to scan, enter the payment amount and authorize the payment to complete the transaction. Merchants do not require and integration with the POS system.

Dynamic QR Payment : QR code owner can change the URL which the QR code redirects to. The process of dynamic QR Payment is easier where customer needs to authorize the QR code to be shown on the app for merchants to scan and do not have to enter the amount to pay, the payment amount will be automatically deducted from users e-wallet.

Who will win: network-based or card-based e-wallet?

Malaysians are familiar and preferable with card payment before the evolution of e-wallet. Even e-wallet has distributed into network-based and card-based, still consumer’s trust is more towards cards. For example, AEON Wallet which is riding on Visa Prepaid Card, the e-wallet (and card) can be used in AEON, AEON BIG, AEON Wellness, etc. When card-based e-wallet providers work with Visa, Mastercard or UnionPay International, their payment products are instantly available to all the existing, card-accepting merchants, without the need to go through the time-consuming merchant acquisition and onboarding process.

Besides, network-based e-wallet has its advantages by allowing consumers to make the payment without bringing along cards or cash and its users able to enjoy various features that card-based e-wallet does not have. For example, Boost (Axiata Digital eCode Sdn.Bhd.) allows users to enjoy shake rewards (50% discounts) for DBKL Parking, Donate, Pay bills, Vouchers and Top Up Prepaid.

No matter it is network-based or card-based e-wallet, the technology keep changing people’s lifestyle and behaviour. The cashless era will come when time files.